Why Arrived Built a Secondary Market

How access to liquidity unlocked peace of mind for investors

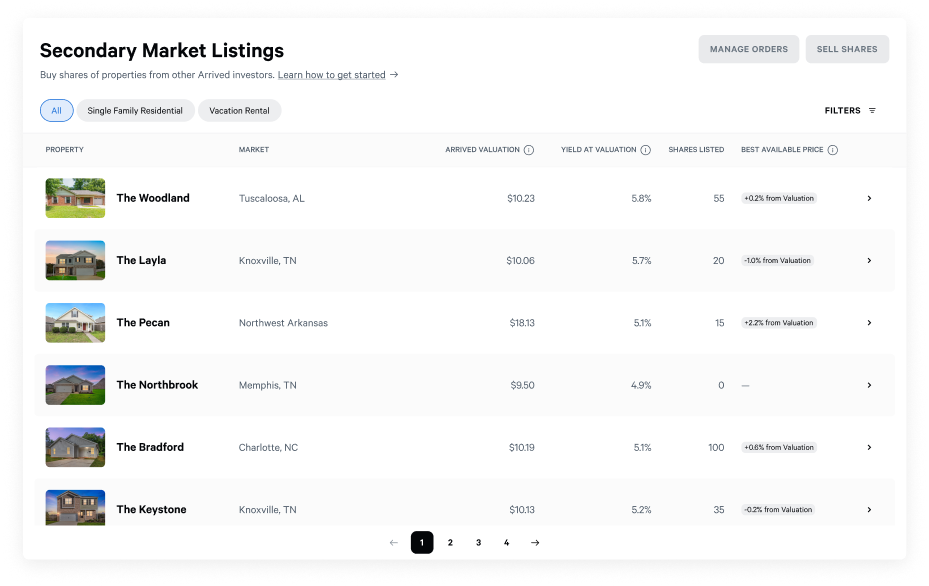

Since 2021, Arrived has been a platform where you can buy shares of individual rental properties.

Since August, Arrived has been a platform where you can sell shares of individual properties.

Access to liquidity was our #1 request from investors. Over the past year, our team worked hard to build out a full secondary market with a user experience that closely resembles a stock trading platform.

Our investors are excited about trading on what’s already the largest platform for buying and selling shares of rental properties, with 400 properties across more than 60 cities.

But more importantly, our investors can finally have some peace of mind.

Last summer, I talked to an investor named Kevin1. Over a 15-month period, he had invested over $30,000 into Arrived properties.

Then he stopped.

Why?

He simply hit the limit of what he was willing to allocate into an illiquid investment where he had no control over operations or ability to exit.

He still liked us! He was happy with his investment results! He didn’t want to sell his shares!

But even with an investor singing our praises, we wouldn’t be able to count on him for additional investment until he had a way to sell – just in case he ever needed it.

Some Quick Background

Each Arrived property is purchased within an LLC. That LLC is fractionalized in a process with the Securities and Exchange Commission. The result is that anyone in the US can buy shares of the LLC, which entitles them to a pro-rata share of the cash flow from renting the property out, as well as any appreciation when the underlying property is eventually sold.

Our offering circular clearly states that we’re aiming to hold our long-term residential properties 5-7 years before looking to sell and that Arrived has full managerial control over that decision (and ability to sell reasonably before or after that 5-7 year window depending on market conditions).

Even with the stated lockup, we felt the product-market fit from our first property launch. The first 6 rental properties were fully funded within three weeks. For much of 2021 and 2022, we simply couldn’t acquire properties and receive SEC qualification on each fast enough to meet investor demand.

Investors wanted access to residential real estate investments they could understand and were OK to trust Arrived to manage the dispositions at some nebulous time in the future.

In hindsight, it’s incredible that we funded ~400 properties without the ability to liquidate.

Importance of Liquidity

However, we knew that a lack of liquidity was going to slow us down eventually.

While I was on our weekly webinars, I’d caution investors not to overcommit.

“Think of the Arrived properties as being similar to making 401(k) or IRA contributions. When you contribute to a retirement account, you KNOW those funds aren’t going to be accessible in the short term. Don’t invest anything you might want or need to use in the short term because there isn’t a way to get the money out of the investment until we sell the home in several years.”

I was spelling out what’s obvious to any sharp investor: liquidity is an important consideration when evaluating an investment. Knowing your options for getting out is critical for cash planning and risk management. Investing in illiquid assets is totally fine (and often necessary for higher returns), but liquidity does play a factor when looking at asset allocations.

This was the right way to set expectations with investors but was obviously going to hamper our growth in the long run. If every new investor was bound to eventually hit their own mental maximum they were willing to invest in our illiquid shares, we’d be artificially constraining our own growth.

We’d already done the hard part! We successfully found potential investors, educated them, provided a good investment experience and strong returns!

And yet the lack of liquidity for peace of mind and “just in case” was going to prevent investors like Kevin from continuing to grow their portfolio with us.

Without offering the ability to liquidate, we’d be building an investment platform with one hand tied behind our back.

So, we casually built an entire Secondary Market

Our goal was to build a secondary market that would enable investors to have confidence that they could sell their shares for a reasonable value if they wanted to exit a position.

The key words there are “reasonable value”.

The secondary market brings buyers and sellers together to determine a market price for the shares independently.

We could build a trading platform system, but if sellers listed their shares and found no interested buyers, it wouldn’t be fair to really say we had liquidity.

Having a market of 400 thinly traded offerings would barely be better than having no market at all.

If sellers needed to take comically large discounts in order to sell their shares, we wouldn’t be providing the peace of mind for investors like Kevin that they’d be able to exit in the future if they needed.

Familiarity Fuels Adoption

We’d need enough participation from buyers and sellers for reasonable market prices to emerge.

But the secondary market is a huge new feature that was going to have a bit of a learning curve to it. It’s inherently a much more complex product. Investors suddenly have hundreds of investments to analyze at once and need to pick the specific price they want to place an order at. There’s no guarantee that a buy or sell order would match with someone on the other side of the transaction.

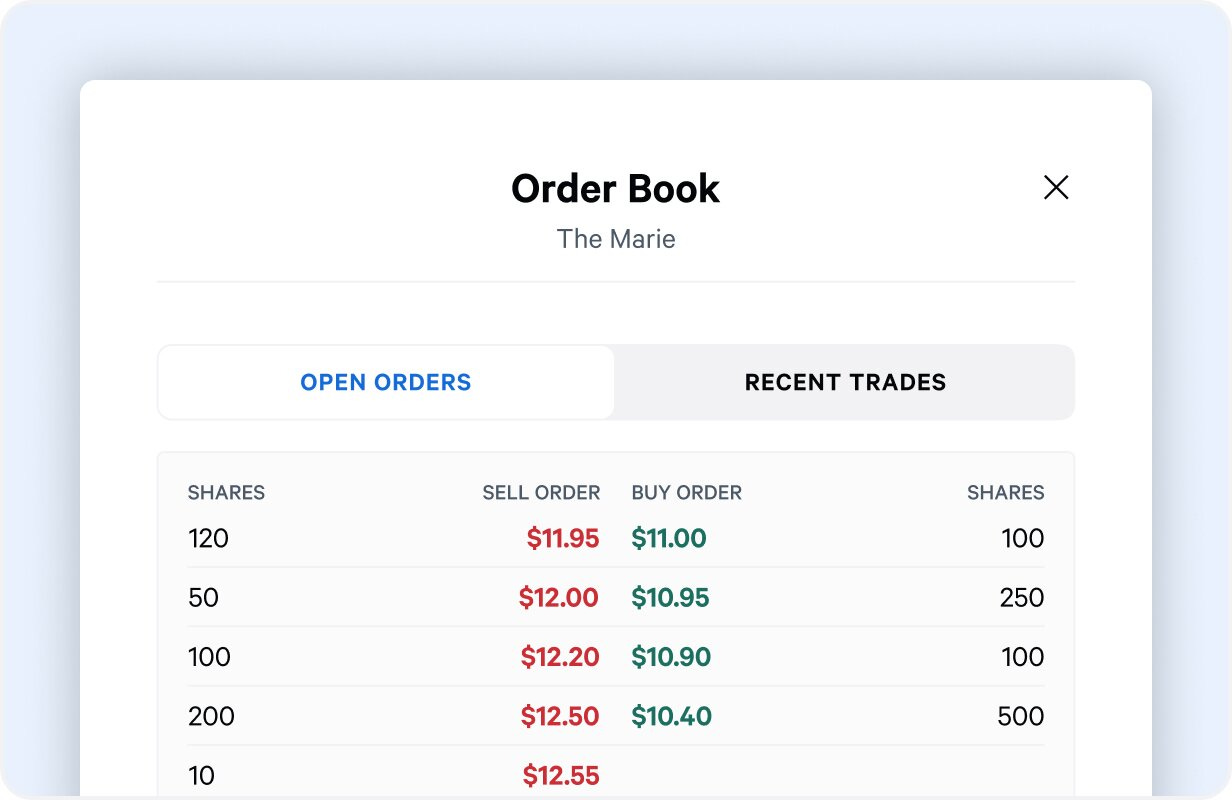

Our best at having fast and broad adoption across investors would be to design the market to be as similar as possible to what investors are used to when trading on Fidelity, E-Trade, Schwab, and other online brokerages. Since our shares would have far less trading volume than any stock, we also looked at other types of markets where investors review an order book to price their trade. This included platforms like StockX, Kalshi, Rally, and Stubhub.

If investors were familiar with the UI, there’d be faster adoption, leading to more participants, which would lead to better liquidity in the whole system, drawing in more investors.

A beautiful virtuous cycle.

On top of our UI, we made several decisions about how the market functions to mirror the stock market.

Like the stock market, investors place limit orders for a specific property. Investors can place buy or sell orders and see the full order book and recent trades. Orders can be placed at any time during the week, including evenings and weekends, but the shares will only transact during trading hours of 9:30-5pm EST.

The biggest difference is that the Arrived Secondary Market is only open for specific trading windows, rather year-round

Market Participants

While Kevin wasn’t interested in actively trading on the secondary market right now, there’s a ton of investors who would be.

There’s very obviously two groups of investors who will benefit immediately from the market’s existence: buyers & sellers!

Buyers

Ahead of the market launch, we talked to investors looking to buy. They typically fell into two camps: A Bargain Hunter or a Collector.

Bargain Hunter’s told us they’d be opportunistic. They were excited by the prospect of snatching up shares from sellers willing to sell at a discount to the current value. To them, almost nothing else mattered about the specifics of the property. These are exactly the type of investors you want in a secondary market because they’d help set a floor for pricing and bid shares up toward a reasonable value.

Collectors are classic Arrived investors. They love that they can buy into different rental homes in different markets across the country. While we have hundreds properties overall, we typically only have 2-5 available at any given moment. Investors may have missed the opportunity to invest in properties in certain markets or properties with certain characteristics (e.g. homes with leverage). Collectors will have an opportunity to essentially shop the back catalogue of Arrived investments to add to their portfolio.

Sellers

Similarly, sellers tend to come in two flavors as well.

The first is the Bolter. Bolters tend to be investors who have decided that we simply aren’t the right investment for them. Some churn is natural for any product. While investors aren’t required to keep making new investments, there hadn’t yet been a way for them to be able to sell the exisiting shares that they already owned.

The more interesting type of seller is the Strategist. These are sharp investors that would be watching the market for opportunity. It may be selling shares they own to take profits and lock in capital gains. It could be re-allocating funds across their Arrived holdings or their overall portfolio allocation. And it could be investors being strategic with the other things in life they need to finance such as a down payment or a child’s college tuition.

Looking Forward

This was no small feat!

Both to nail the technical delivery, but also to intersect with various securities laws and deliver a delightful user experience despite the increased complexity of the product.

Our team dug all the way through the fun details around funding flows, third-party integrations, REIT compliance, investor education, and putting reasonable guardrails in place to limit potential issues.

As a finance nerd, this was a phenomenally fun project to work on. It was quite a challenge to build a marketplace that operates like stock market while adjusting for all the nuances that make our asset class and product unique.

There’s still some obvious limitations of the market: It’s only open intermittently, shares may trade below their current net asset value, and there are transaction fees that will eat into the returns. Still, for a real estate based investment it’s pretty damn liquid.

This is an incredibly novel product. I’m incredibly proud of the whole team for the work over the past year to take this from a general idea into a tightly scoped and well engineered final product.

Now that we’ve unlocked a sell option, it’s time to start iterating. The marketplace will continue to grow as we acquire new properties. As we’ve run 3 different secondary market weeks, we’ve started to gather a ton of feedback from investors on how to improve the trading experience. Most importantly, we want to continue to provide peace of mind for all investors by ensuring there is an active marketplace where they can access liquidity if and when they need it.

Most importantly, we want to continue to highlight the activity on our new marketplace. After all, we built a secondary market to provide peace of mind for all investors by ensuring they can access liquidity if they need it. Removing that hurdle means that investors like Kevin can confidently continue to add real estate to their investment portfolio.

Disclaimer: The views expressed here are my own and do not necessarily reflect those of Arrived. This article is for informational purposes only and should not be taken as investment advice.

Not his real name