7 Things I've Learned from Talking with 1,000 Retail Investors

A look inside how everyday people think about investing in real estate

I’ve spent the last few years talking to more than 1,000 retail investors.

I’ve talked with investors in 1-on-1 calls, webinars, and happy hours. Even now, if you email our support line the odds are high I’ll see your message.

Startups like Arrived are built on user feedback. Our growth has been fueled by a tight feedback loop between investor insights and product development. Talking to investors helps tremendously with the problem identification and validation work I do now on our product management team.

I’ve learned a lot about retail investors through those conversations.

The term “Retail Investor” might conjure feelings of Wall St Bets speculators, but that’s far from reality.

A retail investor is really anyone investing their own capital. It’s a broad group that spans 22-year old’s in their first job to retirees. Retail investors are incredibly diverse in their age, sophistication, and goals. Their financial decisions are shaped more by their life experiences than financial theory.

Every investor is unique, but themes start to surface when you’ve talked to enough of them. Of course, there is some selection bias. The folks I meet are people who discovered Arrived and were motivated enough to talk. Still, their stories highlight some broader observations about how retail investors think.

Here’s a collection of 7 things I’ve learned from talking to 1,000+ retail investors:

People Believe in Real Estate

“I’ve always believed real estate was one of the best ways to build wealth. I’ve seen family and friends do well with rentals over the years, but I never had the time to do it myself. When I found Arrived, it finally felt like there was a way to invest in real estate without having to be a landlord.” – Investor from Austin

This was one of the core insights that led to the creation of Arrived.

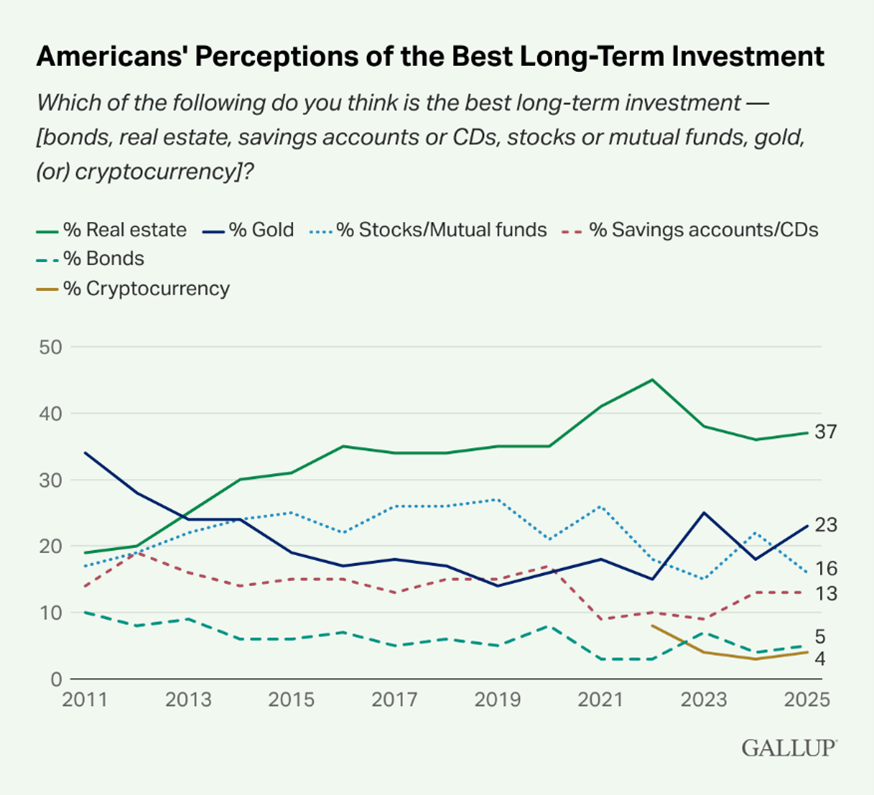

Gallup polls show real estate is American’s preferred long-term investment. The margin has been growing over the last decade.

Yet only a fraction of people who want to invest in real estate actually do. IRS data shows that just 7% of households own rental properties. There’s others that invest in public REIT’s or private syndications, but not enough to make change the conclusion.

There’s a big gap between the ~7% that own rental properties and the ~60% that own stocks. And this is despite real estate being preferred over stocks!

Retail investors already think real estate is a good investment. It comes from their life experiences. They’ve seen the housing market consistently appreciate, particularly in the last 15 years. Personal experience plays a role too. Some investors reference seeing a brother or an uncle be successful as real estate investors or rental property owners. Those observations fuel the assumption that the asset class is a solid investment.

When I talk to investors, it’s never about the merits of why they should add real estate to their portfolio. Our conversations are always about Arrived: how we operate, what our investment theses are, and what to expect from becoming an investor. My hunch is the platforms for fractional art, collectibles, wine or music royalties investments spend a lot more time educating and pitching the asset class than we do.

Real estate shouldn’t be considered an alternative asset. It’s not an esoteric new asset. Consumers are already looking for real estate to shake up their traditional stock and bond portfolio. Investing in real estate has been around for a long time, but now it’s becoming more accessible to the average consumer.

3 Things Prevent People from Buying Rental Properties Themselves

We know from the Gallup poll that there’s a huge gap between the number of people who think real estate is a good investment, and those who actually invest in real estate.

What holds people back?

It always comes down to time, capital, and expertise. Like a 3-legged stool, there’s going to be an accident if one leg is broken.

Time:

“I loved the idea of owning rentals, but I didn’t want to spend my weekends dealing with tenants and repairs.” – Investor from Cleveland

Nobody wants to get the midnight phone call on a Saturday night asking you to call a plumber about the burst pipe that’s flooding the bathroom.

Acquiring and managing a rental property is a significant time commitment. Investors are wary of making an investment that turns into a job.

Capital:

Buying rental property is expensive. Only a fraction of people interested in buying rental properties have the capital to make the down payment. Even those with the funds to buy an entire rental might not want that much concentration in a single asset.

“Even with some savings, gathering enough for a full down payment in my area just never felt realistic.” – Investor from San Diego

Expertise:

Retail investors are drawn to the asset for its usefulness as an inflation hedge, steady income, appreciation, and favorable tax treatment.

What holds them back is knowing how to develop and execute on a strategy. Finding, financing, and managing rental properties takes specialized knowledge, and the learning curve can be intimidating when so much capital is on the line.

“I knew real estate was a good investment, I just had no idea where to start or how to pick the right property.” – Investor from Baton Rouge

There’s a Shift from Active to Passive Investing

“You know, I’m just trying to find ways to diversify and get out of the headaches of every day landlording.” – Investor from Laguna Beach

“I was looking for similar returns without the hassle. It was a lot of work just to collect rent when it was due every month” – Investor from Tampa Bay

A lot of investors tell me about how they owned rental properties in the past, and are specifically interested in Arrived because it’s passive. They’ve lived the landlord life before. They don’t want to go back.

Current landlords regularly ask if they can 1031 exchange their properties into Arrived in order to leave active management. There are 20.5 million rental properties owned by mom-and-pop landlords. As the Silver Tsunami wave of aging Americans continues over the next decade, expect to see owners feel burnt out of management and look to exit.

Whether they own rental properties now or in the past, there’s a clear shift of investors looking for more passive opportunities.

Building Trust is Everything, and There’s More Than One Way to Do It

Retail investors rely more on trust than spreadsheets. They invest when they believe in the people behind the platform.

Building trust looks different at every stage of growth.

The early adopters who invested in our first properties didn’t have much of a reason to trust us. They saw some early press in Geekwire and were willing to invest a small amount in a novel idea. The first investments were modest, but it was a thrill to see them coming in from people we hadn’t spoken with directly.

Our next phase of trust came through associations. We had a number of notable VC and angel investors in our Series A round, but none more recognizable than Bezos Expeditions, the personal investment company of Jeff Bezos. For about 2-years, I’d hear investors say that Bezos’s (small) involvement was enough for them to feel comfortable taking a chance on a new startup.

As we operated rental properties, we continued to gain trust with our exisiting investors. A common theme was that we did what we said we were going to do. Investors were delighted when we leased a property for more than the initial forecast, and our regular dividend payments reinforced that we were capable operators. Each successful step garnered more goodwill with investors.

Today, our scale builds trust on its own. With more than 500 properties, four years of dividend payments, and starting to sell our initial properties for a profit, investors can see the results for themselves. Our regular webinars allow us to talk to dozens of investors at once, answer their questions, and make sure there’s still a personal touch.

Investors need trust to take the leap of faith and make an investment. There’s no single formula. It comes from consistency, transparency, and delivering on promises over time.

Everyone’s Portfolio Reflects Their Life Experiences

I regularly talk with investors one-on-one and we usually start with their background. What are they currently invested in? Why are they interested in real estate? What are they looking for?

It’s fascinating how open people are.

Each investor is different. They have their own unique story and perspectives. Fears and goals. It’s really interesting to hear different narratives about why people invest the way they do. You can hear the life experiences that directly shape their risk tolerances.

Because of that, they value investment criteria differently. Some care the most about a home’s curb appeal, financial ratios, or the school district rating.

Some investor view dividends as the main reason they’re investing with any appreciation as the cherry on top. Others have the exact opposite approach, where they’re looking for appreciation over time and it’s the dividends that are a bonus.

They also tend to have an affinity for places they’ve been. We often get requests from investors to expand to cities around the US, and they’re typically places that the investor has personally experienced and believes in based on the growth happening in that particular area.

Others are driven by their financial goals. Some love the stability of real estate because they can’t stomach the volatility of stocks. Some look for income-focused returns to supplement their retirement. A few just love investing and adding new alternative assets to their portfolio.

As Arrived has expanded into different types of real estate, it’s become easier for investors to find something that fits their specific objectives.

“I’ve always been heavy in stocks, but the swings lately have been stressing me out. Real estate feels steadier. I get the consistent dividends to lock in some returns and still have some appreciation in the future” – Investor from Boulder

“Personal finance is more personal than finance” – Morgan Housel

Investors are looking for more than just another REIT

There are easy ways to invest in real estate through a brokerage account, but they fall far short of what most retail investors actually want.

Retail investors want simple, understandable ways to invest in real estate that provides steady cash flow and appreciation. The public REIT’s and real estate funds available via brokerage accounts don’t fit the bill.

Public REITs have been around since the 1960s and give investors some exposure to real estate. Most investors own them indirectly through their index funds and target date funds, but it’s far different than having a meaningful allocation to real estate.

Few investors specifically seek out REITs directly. Those who do often find it difficult to understand what they’re buying. The underlying properties are buried in 10-K filings and quarterly reports, and there’s little transparency into what they actually own.

REITs also behave more like public equities than private real estate. Their prices move with interest rates, sentiment, and broader market swings. Valuations are more reflective of the operating company’s performance than the growth of the real estate itself. Investors aren’t looking for another stock. They want direct exposure to the income and appreciation that real estate provides.

Exisiting options are complex and impersonal. difficult to understand. Investors are craving plain-language, transparent ways to invest in real estate that don’t correlate with public equities.

Real Estate is Quickly Moving Online

Stocks used to be analog too. Over the last 75 years, technology made the stock market significantly more accessible. Phone calls, brokers, and commissions transitioned to seamless brokerage apps.

The same thing is happening with the real estate market.

Most real estate syndications have high minimum investments and require personal connections to access deals. Now there’s several online real estate options to add the same strategies to your portfolio with just a few clicks.

I’ve seen the change firsthand. More investors are comfortable making sizeable investments without talking to someone at Arrived individually. Awareness and comfort with the category is growing.

The shift won’t just be for investments. There’s a lot of innovation happening within the PropTech and FinTech worlds. Expect to see more real estate experiences move online in the next decade.

After talking to more than 1,000 retail investors, I’ve learned how unique each investor each one is. There are similar themes, but no two are exactly alike. Behind every question is genuine curiosity and a reflection of their own goals, fears, and life experiences.

Their needs boil down to the same simple things. They want trust and transparency. They want understandability. They want access to an asset class they believe in and are becoming more comfortable using online platforms to give their hard-earned cash to others to manage.

The future of investing will belong to the companies that truly listen to those needs and build with them in mind.

There’s always more to learn, and I’m looking forward to the next 1,000 conversations.

Disclaimer: The views expressed here are my own and do not necessarily reflect those of Arrived. This article is for informational purposes only and should not be taken as investment advice.